How to Provide Evidence of Your Income

How to Provide Evidence of Your Income

There are some activities that you cannot get involved in if self-employed unless you show proof of your income, you can click here for more info. For instance, if you want to rent new apartment, some real estate firms will insist of having your proof of income, read more now, or click this page. Apart from the real estate agents, and companies, you cannot request a loan from any financial institution without showing proof of your income. So, even the self-employed individual must show proof of their income before they can access some services in the field. Here are the various ways by which one can show proof of income even if self-employed.

First, you can show proof of your income by the use of bank statement. If you want to show proof of your income to any institution, one of the best things to use is the bank statement. Even if you are not employed by the state authorities, if you have been saving some money from in your account, the bank has all the records to act as proof of all the transactions. Therefore, if you want to rent an apartment or request loan from any financial institution, you can use your bank statement to show proof of income. It is easy to get a bank statement, for printed ones consult your banking service provider, but you can still download it via the bank’s website, or app.

Another important document you can use to show proof of income is your tax return. The law of different states in the world, requires every adult citizen to file tax return. The tax return shows individuals income for the whole years. Therefore, one of the important documents that is acceptable in many institutions that require proof of income is the tax return paper. Therefore, if you want to borrow money from a lending facility, the other best document to use as proof of income is your tax returns. Getting your tax return document is easy, you can get it online from your portal at the revenue authority website.

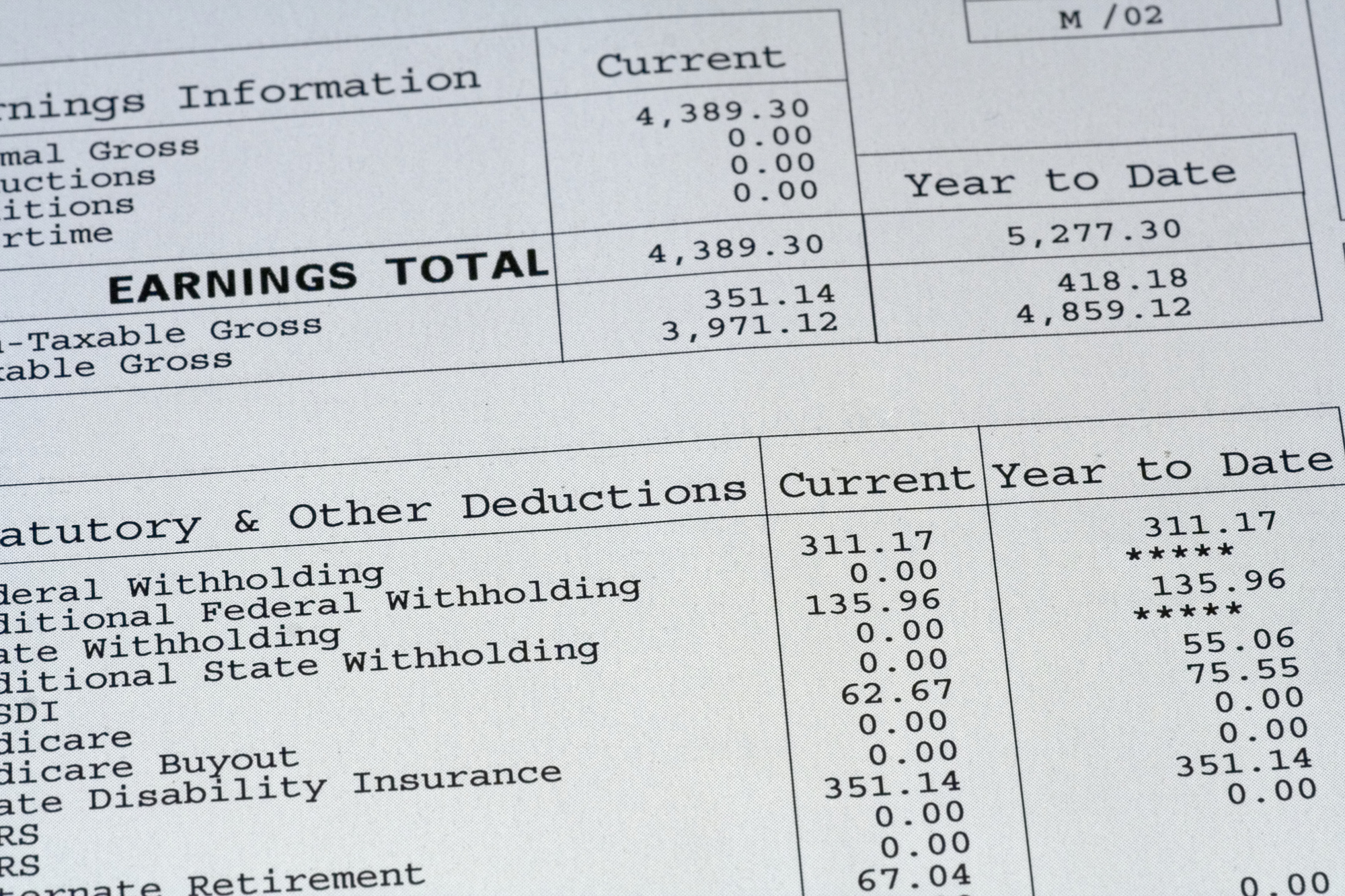

Also, you can use pay stubs and W-2 to pay yourself if self-employed, and use the records as proof of income. Majority of people think that only individuals employed by the government should use pay stubs and W-2, but even the self-employed people can pay themselves using this system. It is advisable that instead of taking time filling out 1099, or directing payments to your bank account, it is better to pay yourself using W-2. The good thing of using W-2 is that you can generate pay stubs every week or month. The documents you generate using the system will act as proof as your income.

Refer to: look at here