You have to be very responsible when you are going for the self-employed option in any kind of business now!. Running a business by yourself means that you can draft self-employed payroll. You are supposed to use the self-employed payroll as a way to make plans in your business so that you can be set up for more success. Hence, you are supposed to be aware of the best means of creating a self-employed payroll that you can use. You are advised to search for a self-employed payroll platform that you can utilize when it comes to getting a self-employed payroll. Therefore, here is how you can choose a good self-employed payroll service provider.

You have to settle for a self-employed payroll platform that is very reliable when it comes to this task. You are supposed to go for a self-employed payroll solution center that you are certain about. This means that you must look into the certifications of the self-employed payroll service provider. Make sure the self-employed payroll service provider has been in business for long by checking their website. This is the kind of self-employed payroll solution center that has been developed well to fit the needs that you will have. You are supposed to look into the remarks that the self-employed payroll solution center.

You are also supposed to look for self-employed payroll software that you can utilize when handling such work and learn more about it. You are supposed to click for more factors to consider using the self-employed payroll software for you to get to do things yourself. The automation that is provided by the self-employed payroll software is what will help you have a simpler time. The most popular self-employed payroll software is the one that you should go for. You are supposed to look at the way the self-employed payroll software works. This will help you determine if you can rely on the self-employed payroll software for every aspect of the payroll process.

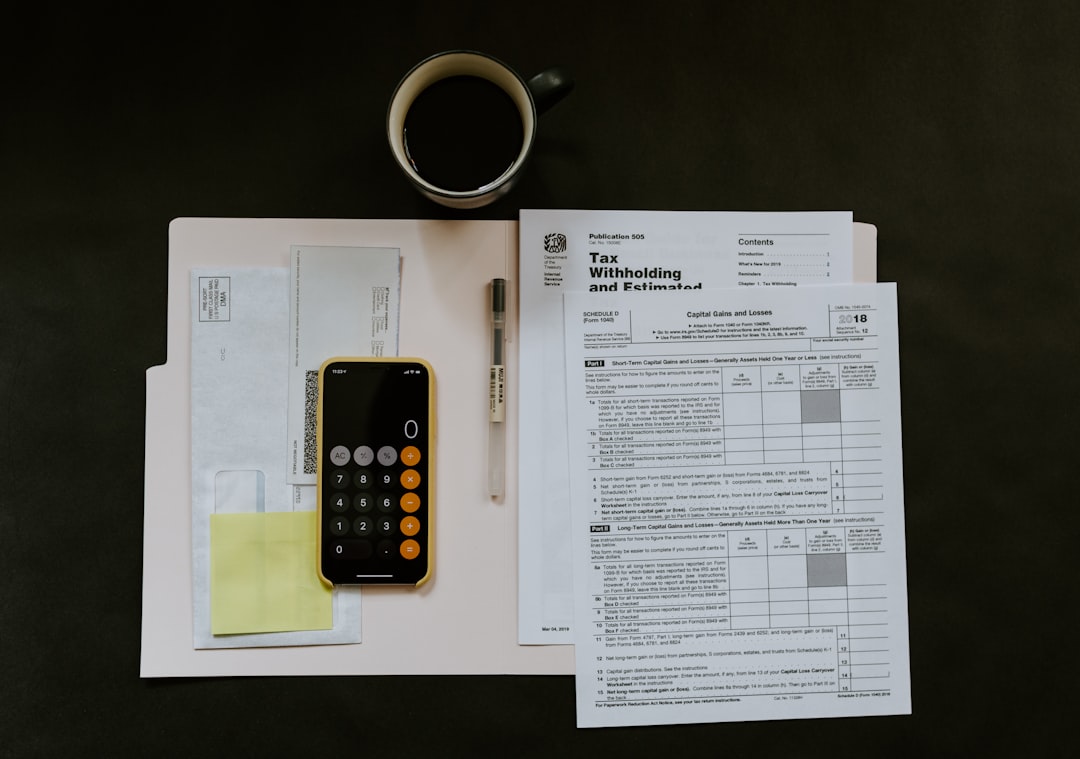

Finally, you are supposed to understand the kind of self-employed payroll taxes that one is supposed to pay as you discover more. You are supposed to understand that the self-employed payroll taxes will be charged from the business income. You should be aware that your money is not in any way involved in the self-employed payroll taxes that are needed. Therefore, you are free to withdraw whatever amount you want from the business that you have. You have to make sure you have banked your income in the business well. Been self-employed means that you have to plan for your income will be divided.